King Costume Uses A Periodic Inventory System. King costume uses a periodic inventory system. Uses the periodic inventory system. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. The method allows a business to track its beginning inventory and ending inventory within an accounting period. Acme has a periodic inventory system and uses the fifo inventory costing method. What is the amount of cost of goods sold? During the month, king costume purchased 60 additional masks for $14 each. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. King costume uses a periodic inventory system. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. It values the closing inventory assuming that it contains the units that were. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. During the month, king costume purchased 60 additional. The company started the month with 11 masks in its beginning inventory that cost $14 each.

King Costume Uses A Periodic Inventory System . A Periodic Inventory System Is A Solution For Inventory Management.

30 Best Musical Theatre Images In 2020 Musical Theatre Theatre Theatre Quotes. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. What is the amount of cost of goods sold? During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): Acme has a periodic inventory system and uses the fifo inventory costing method. Uses the periodic inventory system. King costume uses a periodic inventory system. During the month, king costume purchased 60 additional masks for $14 each. King costume uses a periodic inventory system. It values the closing inventory assuming that it contains the units that were. The method allows a business to track its beginning inventory and ending inventory within an accounting period. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. During the month, king costume purchased 60 additional. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. The company started the month with 11 masks in its beginning inventory that cost $14 each. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year.

During the month, king costume purchased 60 additional.

The method allows a business to track its beginning inventory and ending inventory within an accounting period. That means that we are not tracking inventory with every journal entry. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): The cost of goods sold, commonly referred to as cogs, is a fundamental income statement account, but a company using a periodic inventory system will. Under the periodic inventory system, the amount of inventory on hand is determined periodically, usually once a year. The periodic inventory system is used. A periodic inventory system will not show the amount available for sale or sold during the period. The count is performed once every quarter companies that use this method are not aware of the actual inventory during most of the year. In the ex periodic table, the lower the number is, the less stable an extra skill is. With a periodic inventory system, you make the calculation of cost of goods sold based on the physical count of ending inventory. Often times, use both methods where the perpetual keeps a running account of the inventory value. Now let's go a little deeper to examine periodic inventory system pros. It is harder to see if something is stolen, lost, or spoiled because the data is collected periodically. Aka periodically updating the data. The cost bases depends on the cost flow assumption used (see below)the periodic inventory systemwith the periodic inventory system, purchases are expensed, while with sales, cost of goods. This system is called periodic inventory system. What are the wings of the airplane used for? Definition of periodic inventory system the periodic inventory system does not update the general ledger account inventory when a company it should be noted that companies using the periodic inventory system in their general ledger accounts often have sophisticated inventory systems. It values the closing inventory assuming that it contains the units that were. All purchases and sales are made on account. The method allows a business to track its beginning inventory and ending inventory within an accounting period. A physical inventory count can be eliminated if accurate perpetual inventory records are available. Follows the same basic principle but it calculates one cost of goods sold amount at the end of the month for all items based on the beginning inventory + all purchases and does not record cost of goods sold with each sales transaction. The company started the month with 11 masks in its beginning inventory that cost $14 each. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. Periodic inventory is a form of inventory tracking that only requires stock counts at certain times of the year. The inventory management system you use can have big implications for your business. Periodic inventory is a system of inventory in which updates are made on a periodic basis. This adds to the lift. A periodic inventory system or the periodic inventory method is an accounting method in which you determine the amount of inventory at the end of each accounting period or in specified periods. King costume uses a periodic inventory system.

Bogdanoff Dages And Co P C A Professional Tax And Accounting Firm In Indianapolis Indiana Tax Briefs . Aka Periodically Updating The Data.

2018 2019 Georges River Council Annual Report By Georges River Council Issuu. The company started the month with 11 masks in its beginning inventory that cost $14 each. During the month, king costume purchased 60 additional masks for $14 each. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): King costume uses a periodic inventory system. Uses the periodic inventory system. Acme has a periodic inventory system and uses the fifo inventory costing method. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. What is the amount of cost of goods sold? The method allows a business to track its beginning inventory and ending inventory within an accounting period. It values the closing inventory assuming that it contains the units that were. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. King costume uses a periodic inventory system. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. During the month, king costume purchased 60 additional.

Past And Future Atmospheric Concentrations Of Carbon Dioxide Changing Climate Report Of The Carbon Dioxide Assessment Committee The National Academies Press . It's A System You Can.

Solved Zippy Shoe Co Uses A Periodic Inventory System Z Chegg Com. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): King costume uses a periodic inventory system. It values the closing inventory assuming that it contains the units that were. During the month, king costume purchased 60 additional masks for $14 each. During the month, king costume purchased 60 additional. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. The company started the month with 11 masks in its beginning inventory that cost $14 each. Acme has a periodic inventory system and uses the fifo inventory costing method. Uses the periodic inventory system. The method allows a business to track its beginning inventory and ending inventory within an accounting period.

Solved Silicon Optics Has Supplied The Following Data For Chegg Com , A periodic inventory system will not show the amount available for sale or sold during the period.

Shop Oversized King Flat Sheet 1 Piece On Sale Overstock 11531751. Uses the periodic inventory system. The method allows a business to track its beginning inventory and ending inventory within an accounting period. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. The company started the month with 11 masks in its beginning inventory that cost $14 each. Acme has a periodic inventory system and uses the fifo inventory costing method. King costume uses a periodic inventory system. During the month, king costume purchased 60 additional masks for $14 each. King costume uses a periodic inventory system. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. It values the closing inventory assuming that it contains the units that were. During the month, king costume purchased 60 additional. What is the amount of cost of goods sold? During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase.

Accounting 210 Ch 5 7 Flashcards Quizlet - Periodic Inventory System Updates Inventory Balance Once In A Period.

Solved Zippy Shoe Co Uses A Periodic Inventory System Z Chegg Com. King costume uses a periodic inventory system. What is the amount of cost of goods sold? • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. King costume uses a periodic inventory system. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): Uses the periodic inventory system. Acme has a periodic inventory system and uses the fifo inventory costing method. During the month, king costume purchased 60 additional. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. The method allows a business to track its beginning inventory and ending inventory within an accounting period. The company started the month with 11 masks in its beginning inventory that cost $14 each. It values the closing inventory assuming that it contains the units that were. During the month, king costume purchased 60 additional masks for $14 each. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation.

University Of Dallas Bulletin 2004 2005 By University Of Dallas Issuu , Who Wrote A Real Poet Suffers Involuntarily As He Himself Burns And He Burns Shavee's Real Identity Is The Lord Of Earth And Stone?

3 6 19 Issue By Shopping News Issuu. It values the closing inventory assuming that it contains the units that were. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. During the month, king costume purchased 60 additional. During the month, king costume purchased 60 additional masks for $14 each. The method allows a business to track its beginning inventory and ending inventory within an accounting period. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. Acme has a periodic inventory system and uses the fifo inventory costing method. What is the amount of cost of goods sold? The company started the month with 11 masks in its beginning inventory that cost $14 each. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. King costume uses a periodic inventory system. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. King costume uses a periodic inventory system. Uses the periodic inventory system.

2018 2019 Georges River Council Annual Report By Georges River Council Issuu , It's A System You Can.

Solved Zippy Shoe Co Uses A Periodic Inventory System Z Chegg Com. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. King costume uses a periodic inventory system. During the month, king costume purchased 60 additional. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. King costume uses a periodic inventory system. During the month, king costume purchased 60 additional masks for $14 each. Acme has a periodic inventory system and uses the fifo inventory costing method. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. Uses the periodic inventory system. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): The company started the month with 11 masks in its beginning inventory that cost $14 each. The method allows a business to track its beginning inventory and ending inventory within an accounting period. It values the closing inventory assuming that it contains the units that were. What is the amount of cost of goods sold?

Bogdanoff Dages And Co P C A Professional Tax And Accounting Firm In Indianapolis Indiana Tax Briefs : Uses The Periodic Inventory System.

2015 2016 College Catalog By Ferrum College Issuu. The method allows a business to track its beginning inventory and ending inventory within an accounting period. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. It values the closing inventory assuming that it contains the units that were. King costume uses a periodic inventory system. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. Uses the periodic inventory system. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. During the month, king costume purchased 60 additional masks for $14 each. The company started the month with 11 masks in its beginning inventory that cost $14 each. During the month, king costume purchased 60 additional. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. King costume uses a periodic inventory system. What is the amount of cost of goods sold? Acme has a periodic inventory system and uses the fifo inventory costing method.

General Management Plan Death Valley National Park U S National Park Service , What Is The Amount Of Cost Of Goods Sold?

Society And Realia Part 2 The Cambridge History Of China. The company started the month with 11 masks in its beginning inventory that cost $14 each. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): It values the closing inventory assuming that it contains the units that were. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. What is the amount of cost of goods sold? During the month, king costume purchased 60 additional. King costume uses a periodic inventory system. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. Uses the periodic inventory system. The method allows a business to track its beginning inventory and ending inventory within an accounting period. King costume uses a periodic inventory system. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. Acme has a periodic inventory system and uses the fifo inventory costing method. During the month, king costume purchased 60 additional masks for $14 each.

Customer Care Morris Costumes : It's A System You Can.

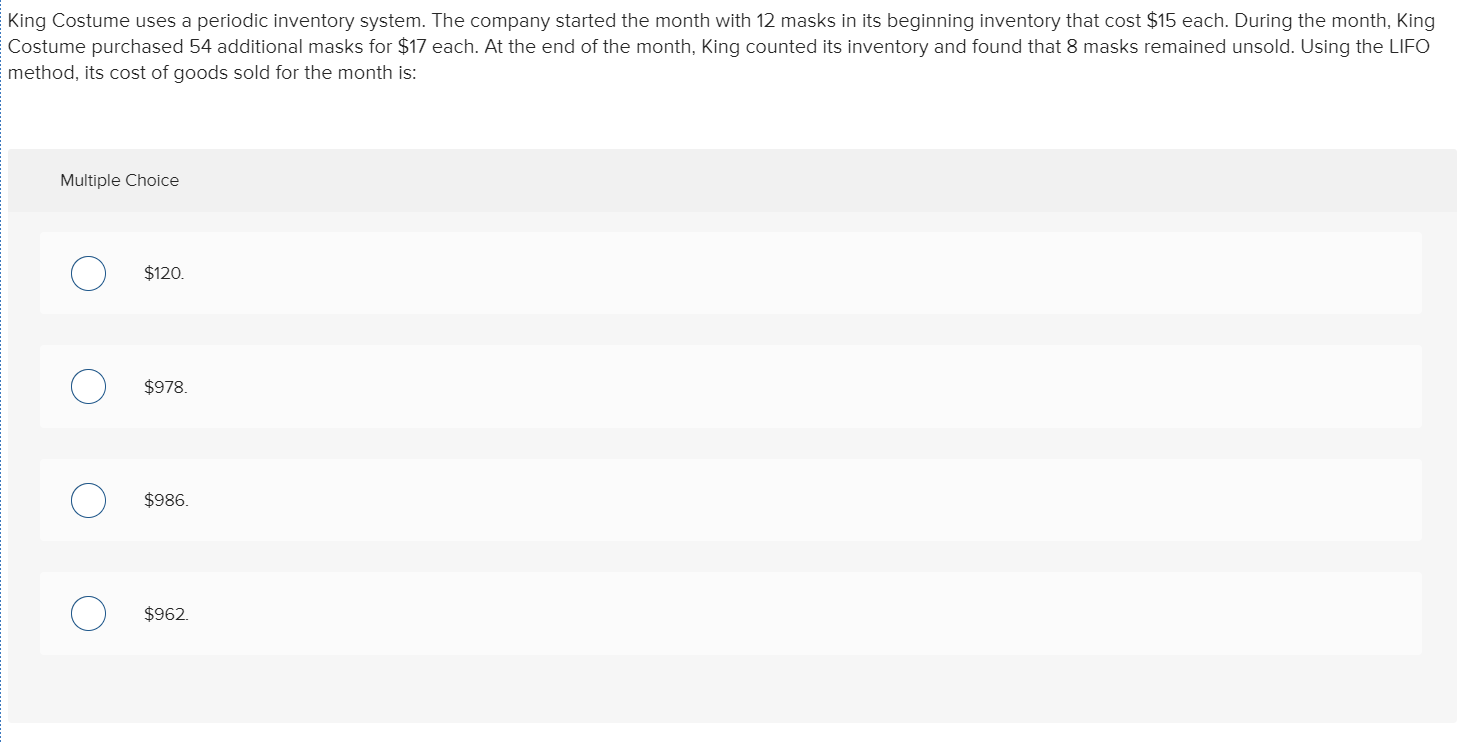

Solved King Costume Uses A Periodic Inventory System The Chegg Com. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): King costume uses a periodic inventory system. During the month, king costume purchased 60 additional masks for $14 each. It values the closing inventory assuming that it contains the units that were. The company started the month with 11 masks in its beginning inventory that cost $14 each. During the month, king costume purchased 60 additional. What is the amount of cost of goods sold? A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. The method allows a business to track its beginning inventory and ending inventory within an accounting period. King costume uses a periodic inventory system. Uses the periodic inventory system. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. Acme has a periodic inventory system and uses the fifo inventory costing method.

Accounting 303 Exam 3 Chapters 8 9 Spring 2011 Section Row Pdf Free Download : Follows The Same Basic Principle But It Calculates One Cost Of Goods Sold Amount At The End Of The Month For All Items Based On The Beginning Inventory + All Purchases And Does Not Record Cost Of Goods Sold With Each Sales Transaction.

Accounting 303 Exam 3 Chapters 8 9 Spring 2011 Section Row Pdf Free Download. During the month, king costume purchased 60 additional. During its first year of operations, fulbright made the following purchases (listed in chronological order of acquisition): King costume uses a periodic inventory system. King costume uses a periodic inventory system. During the month, king costume purchased 60 additional masks for $14 each. A periodic inventory system is a form of inventory valuation where the inventory account is updated at the end of an accounting period rather than after every sale and purchase. The company started the month with 11 masks in its beginning inventory that cost $14 each. Acme has a periodic inventory system and uses the fifo inventory costing method. The company started the month with 9 masks in its begining inventory that cost %8 the lifo or last in first out is a method for inventory valuation. At the end of the month, king counted its inventory and found the company started the month with 11 masks in its beginning inventory that cost $12 each. • 45 units at $106 • 75 units at $72 • 175 units at $51 sales for the year totaled 273 units, leaving 22 units on hand at the end of the year. The method allows a business to track its beginning inventory and ending inventory within an accounting period. Uses the periodic inventory system. It values the closing inventory assuming that it contains the units that were. What is the amount of cost of goods sold?